Opening the Keys of Effective Attaching American Hartford Gold

Introduction

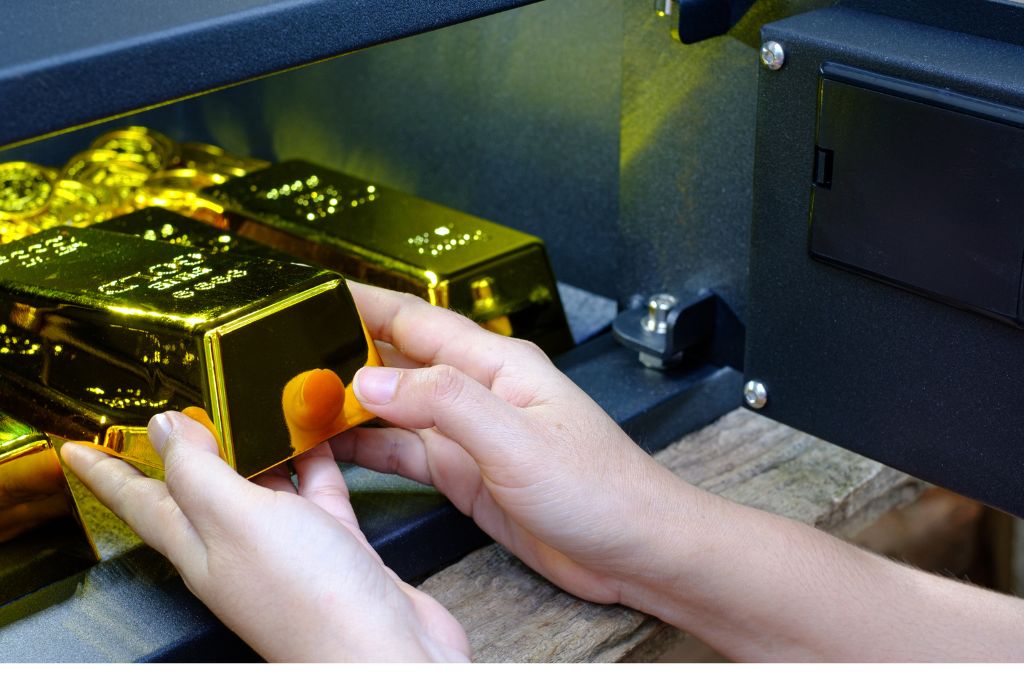

Investing can typically seem like embarking on a treasure hunt– packed with excitement however likewise stuffed with uncertainties. The globe of finance is split, and navigating it requires not only knowledge however also trusted partners. In this mission, American Hartford Gold stands out as a sign for savvy investors wanting to expand their portfolios via rare-earth elements, particularly gold and silver. But what makes American Hartford Gold a prudent option for your financial investment trip?

In this thorough article, we’ll check out the many aspects that add to effective investing with American Hartford Gold, including understandings into their solutions, fees, rates, and client testimonials. So grab your compass; we’re about to unlock the keys of effective investing!

Unlocking the Tricks of Effective Investing with American Hartford Gold

When it involves investing in rare-earth elements, having a trusted partner can be vital. American Hartford Gold positions itself as a leader in this industry by using tailored remedies made to fit individual investment approaches. They give an array of services that deal with both new capitalists and experienced pros alike.

Understanding Rare-earth elements Investment

What Are Precious Metals?

Precious metals like gold, silver, platinum, and palladium have innate value and are usually viewed as safe havens throughout economic turmoil. Capitalists flock to these steels not simply for their charm but also for their capability to keep value over time.

Why Purchase Priceless Metals?

American Hartford Gold: A Brief Overview

Founded in 2015, American Hartford Gold has actually swiftly gotten acknowledgment in the financial investment landscape as a reliable dealership in precious metals. Their objective focuses on making the procedure of investing in silver and gold simple and accessible.

Key Features of American Hartford Gold

- Transparent Pricing: Unlike various other gold individual retirement account firms, they satisfaction themselves on transparent pricing structures.

- Exceptional Customer Service: Their group is understood for being receptive and practical throughout the financial investment process.

- Educational Resources: They give important resources to help inform capitalists concerning market fads and financial investment strategies.

Services Offered by American Hartford Gold

Gold individual retirement account Accounts

One of one of the most substantial offerings from American Hartford Gold is their gold IRA service. This allows investors to hold physical gold in a tax-advantaged retirement account.

Benefits of a Gold IRA

- Tax benefits comparable to conventional IRAs

- Ability to buy physical properties as opposed to paper assets

- Potential for long-lasting growth

Direct Acquisitions of Precious Metals

In enhancement to Individual retirement accounts, you can acquire rare-earth elements straight from American Hartford Gold. This versatility allows investors the choice to have physical silver or gold without undergoing an individual retirement account setup.

Fees Associated with American Hartford Gold

Understanding American Hartford Gold Fees

When considering any type of investment firm, recognizing fees is vital as they can eat right into profits over time. Here’s what you require to find out about the costs associated with American Hartford Gold:

1. Setup Fees

These initial costs are incurred when opening up an IRA account with them.

2. Storage Fees

Physical gold has to be kept firmly; thus storage space charges will use based on your chosen facility.

3. Transaction Fees

Whenever you get or sell precious metals through them, deal costs may apply.

Table: Summary of Usual Costs at American Hartford Gold

|Fee Type|Description|Approximated Expense|| —————–|—————————————|————————-|| Configuration Charge|Initial cost for opening an IRA|Varies (check website)|| Storage space Fee|Yearly charge for protecting your assets|$100 – $300|| Purchase Charge|Expense per purchase|Varies (market price)|

Pricing Framework at American Hartford Gold

Understanding Pricing

Investors frequently question how prices are established at companies like American Hartford Gold. The rate of gold changes based upon market conditions however right here’s a breakdown:

1. Market Price

The area price is what you’ll pay when buying gold or silver.

2. Premiums

In enhancement to spot rates, premiums are included based on variables such as demand and rarity.

Table: Present Rates for Significant Rare-earth Elements (Hypothetical)

|Metal|Place Rate (Hypothetical)|Typical Costs|| ————-|—————————|——————-|| Gold|$1,800/ oz|$100|| Silver|$25/oz|$5|| Platinum|$1,000/ oz|$50|

American Hartford Gold Reviews: What Clients Are Saying?

Gathering Customer Feedback

Customer evaluations play an essential duty in gauging the reliability of any type of firm. Let’s dive into what individuals are stating concerning their experiences with American Hartford Gold:

Positive Reviews

- Many consumers compliment their excellent customer service.

- Transparency regarding pricing has been kept in mind repeatedly.

Constructive Criticism

Some clients have actually shared worries over delays in product distribution which may vary based on market conditions.

FAQs About Investing with American Hartford Gold

American Hartford Gold user reviews

1. What kinds of investments does American Hartford Gold offer?

American Hartford Gold primarily supplies silver and gold financial investments via Individual retirement accounts and direct purchases.

2. Exist any hidden costs associated with my investment?

No! They pride themselves on transparency regarding all fees associated with deals or accounts.

3. How do I open a gold IRA account?

You can easily open up an account online or by calling among their reps that will certainly assist you via the process.

4. Can I store my acquired metal at home?

While it’s feasible, it’s suggested to make use of secure storage space facilities offered by them for safety and security reasons.

5. Is my investment safe?

Yes! When spending through an individual retirement account or safe and secure storage choices supplied by certified custodians ensures your property’s safety.

6. How do I sell my rare-earth elements back?

Selling back is simple; get in touch with customer care for support with valuation and transaction processing.

Conclusion

In summary, opening the secrets of successful investing entails mindful factor to consider and trustworthy collaborations– like those offered by American Hartford Gold With their clear rates structures, remarkable customer support ratings, instructional resources, and diverse offerings– from Individual retirement accounts to direct acquisitions– they function as a strong structure upon which both novice and skilled financiers can build their portfolios centered around priceless metals.

By understanding charges entailed with financial investments in addition to current market characteristics surrounding rates frameworks– investors can make informed choices that line up well with their economic goals! So why not take that first step in the direction of protecting your economic future today?

Whether you’re interested in diversifying your retired life profile or merely safeguarding your riches versus economic unpredictability– American Hartgold stands poised as an ally prepared to assist you every step along the way!

From Woodland to Mug: Exploring the Origins of Mushroom Coffee

Introduction

Mushroom coffee has been making waves in the wellness neighborhood, changing just how we think of our early morning mixture. While traditional coffee has long been liked for its stimulating impacts, mushroom coffee is currently being identified for its one-of-a-kind wellness advantages and earthy flavor profile. However just what is mushroom coffee, and where did it come from? In this comprehensive exploration, we will dig deep into the beginnings of this intriguing beverage, tracing its trip from forest to cup.

What is Mushroom Coffee?

Mushroom coffee is a blend of routine coffee and medical mushrooms. It’s not just about adding mushrooms to your daily cup; it entails meticulously picked fungis known for their health and wellness benefits. Usual ranges consist of Lion’s Hair, Chaga, Reishi, and Cordyceps. These mushrooms are abundant in antioxidants, vitamins, and minerals that can boost cognitive feature, boost resistance, and boost general health.

The Nutritional Profile of Mushroom Coffee

When you drink on a cup of mushroom coffee, you’re not simply obtaining high levels of caffeine. You’re also appreciating a myriad of nutrients:

- Polysaccharides: These compounds located in mushrooms can help manage blood glucose levels.

- Beta-glucans: Recognized for their immune-boosting properties.

- Ergothioneine: An antioxidant that assists safeguard cells from damage.

This mix makes mushroom coffee an attractive choice for those seeking a much healthier caffeine fix.

The Background Behind Mushroom Coffee

Ancient Beginnings

The use of mushrooms go back hundreds of years. Ancient human beings revered specific sorts of fungis as sacred or medical. For example:

- China: Making use of Reishi mushroom can be traced back over 2,000 years.

- Egypt: Mushrooms were regarded as food fit for royalty.

These historic usages laid the groundwork for today’s mushroom coffee trend.

The Increase in Popularity

In current years, the attraction with practical foods has risen. Health-conscious people are significantly drawn to choices that guarantee both preference and health advantages. Thus, mushroom coffee has rebounded as individuals seek all-natural treatments to improve their diets.

From Woodland to Cup: The Journey of Medicinal Mushrooms

Cultivation Techniques

Medicinal mushrooms thrive in particular settings. They typically grow in forests where they can absorb nutrients from decaying organic matter.

Wild Harvesting: Some fanatics choose foraging these mushrooms which include substantial expertise about regional flora.

Farming Practices: Lots of business cultivate mushrooms on farms under regulated conditions to ensure top quality and sustainability.

Processing Methods

Once gathered or grown, mushrooms go through various handling methods before they reach your cup:

- Drying: Preserves the mushroom’s residential properties while enhancing flavor.

- Grinding: Creates fine powders or extracts that mix effortlessly with coffee.

This careful handling plays a crucial role in preserving the dietary benefits located in these fungi while guaranteeing a pleasurable taste experience.

The Brewing Process

Choosing Your Base Coffee

For an ideal cup of mushroom coffee, begin with quality beans! Whether you favor dark roast or light roast is completely approximately individual choice; nevertheless:

- Dark roasts often tend to complement the earthy flavors of mushrooms.

- Light roasts enable even more nuanced tastes to shine through.

Brewing Techniques

There are several methods you can utilize to make your mushroom coffee:

- Combine ground mushrooms with coarsely ground coffee.

- Steep for 4 minutes before pushing down.

- Use filteringed system water at 200 ° F( 93 ° C)to draw out maximum flavor.

- A slow put enhances the extraction process.

- For ease seekers, ready-to-drink mixes offer a very easy service without giving up quality.

Each method yields various tastes and strengths!

Health Benefits of Mushroom Coffee

Enhanced Psychological Clearness with Lion’s Mane

Lion’s Mane is renowned for its prospective neuroprotective residential or commercial properties. Research studies suggest it might stimulate nerve development factor (NGF), promoting mind wellness and cognitive function. This makes it an exceptional enhancement to any kind of early morning regular aimed at psychological clarity.

Stress Relief through Reishi Mushrooms

Reishi is frequently called the “mushroom of eternal life.” Its adaptogenic residential or commercial properties aid fight stress and anxiety and anxiousness by regulating cortisol degrees in the body.

Boosted Resistance from Chaga

Chaga mushrooms have actually been shown to improve immune response thanks to their high focus of anti-oxidants. Normal intake may lead you towards less ill days!

Taste Profile: What Does Mushroom Coffee Preference Like?

Flavor Notes Explained

When made correctly, mushroom coffee flaunts distinct flavor notes:

Experimenting with proportions can help you discover your perfect taste balance!

Pairing Suggestions

If you’re questioning what foods match well with mushroom coffee:

|Food Item|Coupling Notes|| ———————–|——————————–|| Dark Chocolate|Enhances resentment|| Almonds|Includes problem & & healthy and balanced fats|| Avocado Toast|Creamy splendor balances tastes|

Finding your best pairings boosts your breakfast game!

Sustainability Considerations in Mushroom Cultivation

Eco-Friendly Practices

Many brands focus on lasting farming practices when cultivating medicinal mushrooms:

Organic Farming: Avoids unsafe chemicals that can affect ecosystems.

Regenerative Farming: Improves soil health through diverse chopping systems.

By sustaining ethical brands, customers add positively towards environmental preservation efforts!

Packaging Choices Matter Too!

Consider brand names that focus on environment-friendly packaging alternatives like compostable bags or glass jars over plastic containers whenever possible!

Mushroom Coffee vs Traditional Coffee: A Contrast Chart

|Function|Typical Coffee|Mushroom Coffee|| ———————-|—————————|—————————-|| Caffeine Web content|High|Moderate|| Health and wellness Perks|Antioxidants|Immune assistance + Adaptogens|| Flavor Account|Bitter|Natural + Rich|

Understanding these distinctions can aid customers make notified options based on their preferences!

FAQ Section

1) Is mushroom coffee safe?

Yes! When consumed properly by healthy individuals (not allergic), it poses no considerable dangers though constantly speak with healthcare specialists if unsure!

2) Can I consume mushroom coffee every day?

Absolutely! Many people appreciate it day-to-day rather than traditional caffeinated drinks as a result of its reduced caffeine web content integrated with included wellness benefits.

3) Will it make me feel high?

Nope! Unlike some entertainment drugs derived from fungi– like psilocybin– mushroom coffees do not contain psychedelic compounds; therefore they won’t produce drunkenness impacts but rather advertise psychological clarity!

4) How many calories does mushroom coffee have?

Typically around 30 calories per serving depending upon just how it’s made (e.g., added sugar). It varies based on ingredients used!

5) Where can I buy high quality mushroom coffee?

Look online at reputable wellness shops or specialty sellers focused entirely on functional foods; some grocery stores may lug pick brands too!

6) Can I make my very own mushroom-infused brew?

Definitely! Acquisition top notch dried out powdered ranges like Lion’s Mane or Chaga then mix them right into your favorite made coffees– experiment till you find what works best for you!

Conclusion

From Woodland to Cup: Checking Out the Origins of Mushroom Coffee reveals not only a fascinating background behind this distinct drink yet additionally highlights its myriad advantages– a fascinating combination washingtonbeerblog.com in between old knowledge and modern health trends! With growing rate of interest bordering useful foods paired with sustainability considerations among manufacturers today– we can anticipate a lot more innovations within this sector moving on into future way of livings accepting much healthier choices without sacrificing pleasure along our journey with life’s simple enjoyments like drinking on warm cups loaded with hope & & sustenance each morning anew!

So why not give it a try? Your taste buds– and body– may thanks later!

Top 10 Best Gold IRA Companies for Secure Retired Life Investments

Introduction: The Value of Gold IRAs in Retirement Planning

In today’s ever-evolving financial landscape, guaranteeing a safe and secure and comfortable retired life has come to be an overwhelming job. With securities market volatility, inflation problems, and economic uncertainties, lots of investors are turning to different properties as a way of protecting their wide range. Among these choices, gold has actually traditionally been deemed a safe house. This article explores the Top 10 Ideal Gold IRA Companies for Secure Retired life Investments, checking out exactly how you can utilize gold IRAs to reinforce your retired life portfolio.

Why Choose a Gold IRA?

A Gold Person Retired life Account (INDIVIDUAL RETIREMENT ACCOUNT) allows you to hold physical gold bullion and coins within your retirement savings strategy. Unlike standard Individual retirement accounts that mostly purchase stocks and bonds, gold IRAs use diversification and defense versus financial recessions. Below’s why you need to think about investing in a Gold IRA:

What is a Gold IRA?

precious metals ira company comparisons

Understanding the Structure of a Gold IRA

A Gold individual retirement account features like any conventional individual retirement account but concentrates on rare-earth elements as opposed to paper possessions. Capitalists can allot funds to get various types of gold items, including bullion bars and coins.

Types of Gold Allowed in an IRA

Not all gold items qualify for addition in an individual retirement account. The IRS specifies details needs regarding purity and type for metals kept in these accounts:

- Gold Bullion Coins: Must be at the very least 99.5% pure.

- Gold Bars: Need to be created by recognized refiners.

How to Select the Right Gold Individual Retirement Account Company?

Identifying Your Investment Goals

Before picking a company, it’s critical to establish your investment goals. Are you searching for lasting security or temporary gains?

Evaluating Fees and Costs

Understanding the fee framework is essential when choosing a gold individual retirement account carrier. Seek:

- Setup Fees

- Annual Maintenance Fees

- Transaction Costs

Top 10 Ideal Gold Individual Retirement Account Companies for Secure Retired Life Investments

1. Noble Gold Investments

Overview of Noble Gold

Noble Gold specializes in precious metals IRAs and has actually gathered positive reviews for its customer care and transparency.

Key Features

- Low fees

- Extensive educational resources

- Wide range of products

2. Birch Gold Group

Company Background

Birch Gold Group has been around given that 2003 and has developed itself as one of the top companies in the industry.

Notable Offerings

- Free appointment services

- Strong concentrate on education

- Flexible storage options

3. Regal Assets

About Regal Assets

Regal Properties is known not just for its gold offerings however also for cryptocurrencies.

Benefits

- Quick configuration process

- Multi-currency options

- High-quality consumer support

4. American Hartford Gold

Insights on American Hartford

This family-owned business prides itself on customized service.

Highlights

- No management charges for the initial year

- Price match guarantee

- Extensive academic material offered online

5. Benefit Gold

Overview

Advantage Gold is identified for its solid instructional focus and customer engagement.

Unique Features

- Educational seminars

- Robust online tools

- Interactive account monitoring control panel

6. Goldco Valuable Metals

Company Profile

Founded in 2006, Goldco concentrates solely on rare-earth elements IRAs.

Advantages

- Excellent credibility with consumers

- Comprehensive overviews offered

- Special promotions frequently supplied

7. SD Bullion

Who is SD Bullion?

SD Bullion provides competitive prices on precious metals transactions.

Noteworthy Aspects

- Wholesale pricing model

- Wide selection of items

- User-friendly platform

8. JM Bullion

Company Insights

JM Bullion uses both retail sales and precious metal IRAs.

Key Points

- Transparent rates

- Fast shipping times

9. APMEX

What Makes APMEX Stand Out?

APMEX offers a substantial selection of precious metal products together with beneficial market insights.

Distinct Features

- Resourceful understanding center

- Competitive delivery rates

10. Patriot Gold Group

Overview of Services

Patriot Gold Team stresses safety and consumer care.

Benefits

- No costs during the initial year

- Comprehensive solution bundle

Comparative Table of Top Companies

|Company|Configuration Charge|Yearly Charge|Minimum Financial investment|Customer Rating|| ———————–|———–|————|——————–|——————|| Noble Gold|$0|$80|$2,000|★ ★ ★ ★ ★|| Birch Gold|$0|$100|$10,000|★ ★ ★ ★ ☆|| Regal Properties|$0|$200|$5,000|★ ★ ★ ★ ★|| American Hartford|$0|$180|$10,000|★ ★ ★ ★ ☆|| Advantage Gold|$50|$150|$25,000|★ ★ ★ ★ ★|| Goldco|$50|$175|$25,000|★ ★ ★ ★ ★|| SD Bullion|Varies|Differs|None|★ ★ ★ ★ ☆|| JM Bullion|Varies|Varies|None|★ ★ ★ ★ ☆|| APMEX|Varies|Differs|None|★ ★ ★ ★ ★|| Patriot Gold Group|$0|-|-|-|

Frequently Asked Inquiries (FAQs)

- Investing in a gold IRA helps expand your profile while safeguarding against inflation.

- Yes! Like typical Individual retirement accounts, contributions might be tax-deductible depending on specific circumstances.

- Generally no; however, some carriers permit you to occupy under certain conditions once specific age restrictions are met.

- Yes; most companies have minimal investment limits varying from regarding $2,000 to $25,000 depending on the provider.

- You can generally hold IRS-approved metals such as gold coins/bars that satisfy pureness requirements set by the IRS.

- You can initiate a rollover or transfer from one more competent retirement through your selected carrier’s guidance.

Conclusion: Safeguarding Your Future with the Right Partner

Investing with one of the Top 10 Best Gold Individual Retirement Account Firms for Secure Retirement Investments is not nearly purchasing physical assets; it’s about safeguarding your financial future amidst unpredictabilities that come with conventional investments like stocks or bonds. By partnering with trusted companies specializing in rare-earth elements IRAs, you’re taking aggressive steps in the direction of building a durable retirement plan that endures time’s tests– making certain peace of mind when it matters most!

In summary, whether you pick Noble Gold’s extraordinary customer care or Regal Property’s one-of-a-kind offerings, each business provided assurances to aid shield your investments while providing support along your trip towards financial independence throughout retirement years!

BPC-157: An Overview of Its Mechanisms and Therapeutic Applications

Introduction

In recent years, the peptide known as BPC-157 has obtained substantial interest for its supposed recovery properties and possible healing applications. Usually described as “Body Defense Substance,” BPC-157 is originated from a healthy protein found in human gastric juice. This short article aims to provide a comprehensive review of BPC-157, including its systems of action, healing advantages, and potential applications in different medical fields.

BPC 157: A Review of Its Devices and Therapeutic Applications

BPC-157 is an artificial peptide that consists of 15 amino acids. It is commemorated for its regenerative capabilities, specifically concerning muscular tissue, ligament, and ligament recovery. The adaptability of BPC-157 has led scientists to discover its effects on different conditions, from sporting activities injuries to inflammatory diseases.

Understanding the Biochemical Structure of BPC-157

What Composes BPC-157?

The structure of BPC-157 comprises a series associated with protective features. It can be damaged down into particular amino acids that add to its unique homes:

These components work synergistically to promote recovery and cells regeneration.

The System of Activity: Just How Does BPC-157 Work?

BPC-157 shows up to exert its results through numerous pathways:

1. Angiogenesis

One crucial system by which BPC-157 promotes recovery is with angiogenesis– the development of new blood vessels from existing ones. This procedure is crucial for supplying nutrients and oxygen to broken cells, therefore speeding up recovery.

2. Collagen Synthesis

Collagen is an essential healthy protein that sustains skin flexibility and the honesty of connective tissues. Research study recommends that BPC-157 boosts collagen synthesis, assisting in the repair service process following injuries.

3. Inflection of Inflammatory Responses

BPC-157 has shown anti-inflammatory residential or commercial properties that assist minimize swelling at injury sites. By controling cytokine release and decreasing oxidative anxiety, it assists in an extra efficient recovery environment.

Therapeutic Applications of BPC-157

Given its complex role in advertising recovery, BPC-157 has a number of prospective healing applications throughout various fields.

1. Sports Medicine

Athletes typically face injuries related to ligaments and ligaments due to the physical demands placed on their bodies. Research studies suggest that BPC-157 might speed up healing from such injuries by improving tissue repair work processes.

2. Stomach Disorders

Beyond musculoskeletal problems, emerging evidence suggests that BPC-157 might additionally profit stomach wellness by promoting mucosal recovery in problems like inflammatory digestive tract illness (IBD) or gastric ulcers.

3. Neurological Disorders

Research into the neuroprotective impacts of BPC-157 reveals guarantee in treating problems like distressing mind injury (TBI) and neurodegenerative conditions because of its capability to go across the blood-brain barrier.

Safety Account: Is BPC 157 Safe for Use?

When taking into consideration any type of healing representative, safety and security is vital. Present research study suggests that BPC-157 exhibits a desirable safety account with minimal side effects reported in research studies including pet models.

Potential Negative effects: What Need To You Watch Out For?

While typically well-tolerated, some people may experience:

It’s essential for people considering BPC-157 therapy to speak with health care experts prior to use.

BPC 157: Dosage and Administration Guidelines

Determining the ideal dosage is essential for making the most of benefits while reducing threats connected with any therapy routine including peptides like BPC-157.

Recommended Dose Ranges

While exact dosages can vary based upon specific requirements and problems being dealt with, typical referrals suggest:

- For muscle mass recuperation: 200 mcg – 500 mcg per day.

- For food poisonings: 250 mcg – 1000 mcg per day.

Administered using subcutaneous injection or intramuscularly relying on the targeted location for treatment.

Future Instructions in Research study on BPC 157

The expanding rate of interest surrounding this peptide has motivated many studies aimed at revealing more insights into its devices and feasible applications:

1. Scientific Tests for Human Applications

Ongoing professional tests will aid establish standardized application guidelines and examine lasting security profiles amongst human populations across various age groups.

2. Expedition in Regenerative Medicine

As regenerative medicine continues developing, there’s potential for incorporating peptides like BPC-157 right into broader healing techniques targeting different degenerative conditions or age-related conditions.

FAQs Regarding BPC 157

Q1: What is BPC 157 used for?

A1: Primarily made use of for promoting healing in muscle mass, tendons, ligaments; likewise discovered for intestinal wellness issues.

Q2: Can I take BPC 157 without a prescription?

A2: It’s advisable to speak with a doctor prior to utilizing it because of varying policies depending upon area and private wellness needs.

Q3: Exactly how is BPC 157 administered?

A3: Typically provided via subcutaneous shot; intramuscular shots are additionally possible based upon therapy goals.

Q4: Are there any kind of negative effects associated with making use of BPC 157?

A4: Generally well-tolerated; nevertheless, moderate nausea or vomiting or injection website reactions may happen in some individuals.

Q5: Exists clinical proof supporting using BPC 157?

A5: Yes; various research studies have revealed positive end results relating to healing procedures in both animal models and preliminary human observations are promising yet call for more recognition through medical trials.

Q6: Where can I acquire top quality BPC 157 products?

A6: It’s vital to purchase from reputable distributors who offer third-party testing results guaranteeing pureness and high quality criteria are met before making any type of acquisitions online or offline.

Conclusion

In final thought, BPC-157: An Introduction of Its Systems and Therapeutic Applications showcases encouraging prospective across numerous clinical areas– from sporting activities medicine to neurological disorders– owing greatly to its multifaceted systems promoting tissue regrowth and repair processes successfully while maintaining a desirable safety and security account overall when utilized as guided under clinical supervision where relevant eventually leading new opportunities in the bpc 157 direction of improved treatments customized around specific client treatment needs moving on as research proceeds developing within this vibrant landscape surrounding groundbreaking explorations leveraging innovative remedies ultimately leading in the direction of improved high quality life experiences amongst those navigating difficulties positioned by chronic ailments calling for effective treatments leveraging innovative growths harnessing breakthroughs forming future horizons lighting opportunities passing through realms once thought unattainable culminating amazing success redefining expectations embodying hope durability lighting courses towards brighter tomorrows!

CBD Oil Myths Debunked: Dividing Truth from Fiction for Your Dog Buddy

Introduction

In current years, the discussion bordering CBD oil for dogs has gained enormous grip. Pet dog proprietors are increasingly interested concerning this compound originated from marijuana plants. With a plethora of information readily available, it’s easy to become overwhelmed or deceived by misconceptions and false impressions. This write-up aims to dig deep right into the numerous myths bordering CBD oil for canines, providing clearness and valid info to assist you make notified decisions for your canine companion.

CBD Oil Myths Debunked: Dividing Reality from Fiction for Your Canine Companion

What is CBD Oil?

CBD, or cannabidiol, is a natural substance located in the hemp plant. Unlike THC (tetrahydrocannabinol), one more popular cannabinoid, CBD does not generate psychoactive effects. This implies that your pet won’t experience any type of “high” from taking in CBD oil. Rather, it supplies therapeutic benefits without the unwanted side effects associated with marijuana.

How Does CBD Oil Operate In Dogs?

The endocannabinoid system (ECS) exists in all animals, including our hairy good friends. It plays an essential role in preserving homeostasis and managing different bodily features like mood, cravings, and pain feedback. When you provide CBD oil for dogs, it interacts with the ECS receptors to promote equilibrium and relieve concerns such as anxiety, discomfort, and inflammation.

Myth 1: CBD Oil is Just One More Kind of Marijuana

One of the greatest false impressions is that CBD oil for dogs belongs to giving them cannabis. While both materials originate from the marijuana family, they are fundamentally various.

The Difference Between CBD and THC

- CBD: Non-psychoactive; deals countless restorative benefits.

- THC: Psychoactive; can be unsafe to pet dogs in high doses.

Understanding this distinction is important for responsible animal care.

Myth 2: All Cannabinoids Are Dangerous to Pets

Many family pet proprietors are afraid that cannabinoids are inherently unsafe. Nevertheless, research reveals that cannabinoids can provide numerous health benefits when used appropriately.

Benefits of Cannabinoids for Dogs

- Pain relief

- Reduced anxiety

- Anti-inflammatory properties

- Improved appetite

When administered correctly under vet support, cannabinoids can be risk-free and beneficial.

Myth 3: There’s No Scientific Proof Supporting CBD Use in Dogs

While more research is needed on CBD make use of particularly in animals, early studies indicate appealing outcomes. For example:

These findings are motivating yet ought to be translated meticulously as further study unfolds.

Myth 4: All CBD Oils Are Produced Equal

Not all CBD oils are developed similarly. Quality differs considerably amongst brands and products.

Factors to Consider When Choosing CBD Oil

- Source of hemp

- Extraction method

- Third-party testing

- Concentration of CBD

Always select credible brand names that supply transparency about their product’s sourcing and making processes.

Myth 5: You Can Provide Your Pet Human CBD Products

This misconception can bring about major health risks. Human CBD products may have ingredients unsafe to canines– such as xylitol or specific essential oils– that can trigger adverse reactions.

Why Specially Developed Pet Products Matter

Pet-specific formulas guarantee that dosages are appropriate and without hazardous additives.

Myth 6: Making use of Too Much CBD Will Certainly Heal Everything

More isn’t always better when it pertains to dosing your pet dog with CBD oil Overdosing can lead to side effects such as sleepiness or digestion upset.

Recommended Dose Guidelines

It’s important to consult your veterinarian before beginning your pet dog on https://theholistapet.com/collections/cbd-oil-for-dogs any kind of brand-new supplement routine– consisting of CBD oil— to establish the right dose based upon their weight and condition.

Common Use CBD Oil for Dogs

Managing Stress and anxiety Disorders

Dogs experience anxiety just like human beings do. Circumstances like thunderstorms or fireworks can trigger panic actions in animals.

How CBD Helps with Anxiety

Research recommends that CBD oil for dogs might minimize anxiety levels by promoting leisure without sedation.

Alleviating Persistent Pain

Chronic pain conditions– such as arthritis– are prevalent amongst older dogs. Standard discomfort medications frequently include unfavorable side effects.

Why Select CBD Over Typical Medications?

Many family pet proprietors have actually reported success making use of CBD oil as an alternative treatment alternative because of its anti-inflammatory properties without dangerous negative effects generally associated with NSAIDs (non-steroidal anti-inflammatory medicines).

Supporting Joint Health

As canines age, joint wellness becomes a significant problem. Conditions like hip dysplasia can severely influence their quality of life.

The Duty of CBD in Joint Support

Due to its anti-inflammatory buildings, many family pet owners have actually turned to CBD oil as an all-natural method to support their pet’s joint health and wellness effectively.

Potential Adverse effects of CBD Oil

While generally thought about risk-free when used appropriately, some canines may experience moderate side effects from CBD oil, including:

If you see any type of concerning adjustments after administering CBD oil, it’s ideal to consult your vet immediately.

How to Carry out CBD Oil Effectively

Choosing the Right Distribution Method

There are several means you can give your pet dog CBD oil, including:

- Directly right into their mouth making use of a dropper

- Mixing it into their food

- Treats instilled with cannabidiol

Each approach has its advantages depending on your canine’s preferences!

Tips for Effective Administration

FAQ Area on CBD Oil Myths Debunked: Separating Fact from Fiction for Your Canine Companion

FAQ 1: Is it lawful to offer my dog CBD oil?

Yes! In a lot of states where marijuana legislations permit hemp-derived products consisting of less than 0.3% THC are legal.

FAQ 2: Can I overdose my pet dog on CBD oil?

While poisoning levels remain reduced compared to typical medicines– it’s still necessary not to exceed recommended dosages given by a veterinarian!

FAQ 3: What signs ought to I look for after offering my pet CBD?

Look out for sleepiness or stomach distress; these can suggest they may need dosage adjustment!

FAQ 4: Will certainly my pet get high from taking hemp-derived oils?

No! Hemp-derived oils contain very little amounts (less than 0..3%)of THC which will not generate psychedelic results commonly connected with marijuana usage!

FAQ 5: How much time does it take before I see results from using cbd?

Results differ based on private elements but numerous record noticing positive adjustments within hours up till days complying with routine usage!

FAQ 6: Exists such thing as excessive potency when choosing an appropriate product?

Absolutely! High-potency items could overwhelm smaller breeds creating unfavorable responses so constantly proceed carefully distributing correct dosages at first & & enhancing gradually with time if required appropriately!

Conclusion

The expanding popularity of CBD oil for dogs brings both exhilaration and issue amongst animal owners navigating via various myths surrounding its use. Comprehending these misunderstandings while equipping yourself with accurate knowledge encourages you as an owner making informed choices concerning what’s ideal fit towards enhancing overall health within our precious friends lives. Always get in touch with professionals before introducing any type of brand-new supplements guaranteeing we prioritize safety and security together with efficiency benefiting our hairy good friends’ health and wellness favorably! Remember, accountable usage paves means in the direction of optimum end results fostering happier much healthier lives together!

The Ecological Impact of Mushroom Farming for Coffee Production

Introduction

In current years, an interesting fad has arised within the coffee industry– mushroom coffee. This innovative drink incorporates standard coffee with various sorts of mushrooms, offering an unique flavor and a variety of health and wellness benefits. As customers end up being extra environmentally aware, they frequently look for lasting alternatives to their preferred items. In this context, the environmental impact of mushroom farming for coffee manufacturing ends up being a considerable topic worth exploring.

Mushroom coffee not just offers a fascinating option to conventional mixtures yet additionally contributes to sustainable methods in farming. It raises questions regarding the equilibrium between coffee cultivation and ecological sustainability, particularly pertaining to logging, water consumption, and dirt degradation. So, allow’s dive deeper right into how mushroom farming influences the ecological landscape while improving our morning cup of joe.

The Ecological Impact of Mushroom Farming for Coffee Production

What is Mushroom Coffee?

Mushroom coffee is a mix of conventional coffee and powdered medicinal mushrooms such as lion’s hair, chaga, or reishi. These mushrooms are celebrated for their purported wellness advantages– ranging from cognitive enhancement to immune assistance. However what does this mean for the environment?

When we check out mushroom farming through the lens of sustainability, it supplies several benefits over standard coffee production techniques. Allow’s explore these advantages further.

The Benefits of Mushroom Farming

1. Minimized Land Use

Traditional coffee farming can need huge amounts of land, usually resulting in deforestation and environment destruction. On the other hand, mushrooms can be grown on relatively tiny plots of land or perhaps in upright farms. This effective use of space not only minimizes land degradation however also motivates city farming initiatives.

2. Enhanced Dirt Health

Mushroom growing can boost dirt high quality by breaking down organic matter and renewing nutrients. This method can bring about much healthier ecological communities that advertise biodiversity– a plain contrast to monoculture coffee farms that remove nutrients and deteriorate dirt over time.

3. Water Conservation

Coffee production is infamous for its high water use, often necessitating irrigation systems that stress regional water resources. Mushrooms normally call for much less water than standard crops as soon as developed, potentially alleviating stress on bordering ecosystems.

4. Carbon Sequestration

By incorporating mushroom farming with existing agriculture techniques (like agroforestry), it’s feasible to improve carbon sequestration capabilities in dirts. This means that even more carbon dioxide is soaked up from the atmosphere, assisting battle climate modification effectively.

Mushroom Coffee Conveniences: A Healthy Alternative

As we’ve already hinted at earlier in this write-up, mushroom coffee isn’t just an environment-friendly selection; it additionally boasts countless health benefits:

1. Cognitive Function Boost

Mushrooms like lion’s hair are stated to boost brain function and memory retention– perfect for those wanting to start their day with clarity.

2. Body Immune System Support

Certain mushrooms are recognized for their immunomodulating properties which may reinforce your body’s defenses versus illness.

3. Lower High Levels Of Caffeine Levels

If you’re sensitive to caffeine or wanting to cut back, lots of mushroom coffees offer reduced high levels of caffeine than normal brews without compromising flavor.

Exploring Mushroom Coffee Alternatives

Though mushroom coffee has gotten popularity rapidly, there are other alternatives available on the market that accommodate comparable demands:

-

Herbal Coffee Substitutes: Combinations like baked chicory or dandelion root mimic some qualities of typical coffee without caffeine.

-

Matcha Green Tea: Known for its antioxidants and calming effects.

-

Adaptogenic Drinks: Blends including ingredients like ashwagandha or maca origin create balanced energy degrees without jitters.

Each choice comes with its very own collection of environmental effects relying on farming approaches and sourcing practices.

Where to Get Mushroom Coffee?

If you’re fascinated by the idea of including mushroom coffee right into your daily routine yet aren’t certain where to begin, consider taking a look at local health food shops or online stores concentrating on natural products.

Popular brand names include:

- Four Sigmatic

- RISE

- MudWtr

These companies highlight sustainable methods and provide openness regarding their sourcing techniques– elements necessary for eco-conscious consumers today.

Sustainable Practices in Mushroom Farming

1. Organic Certification

Choosing naturally expanded mushrooms assists make certain that no damaging pesticides or chemicals are utilized during growing– which protects both human health and the environment.

2. Sustainable Sourcing

Many business concentrate on sourcing mushrooms from manufacturers that prioritize honest farming techniques and fair trade concepts– making sure that both farmers and consumers benefit from sustainable choices.

The Function of Modern technology in Lasting Mushroom Farming

Incorporating technology into farming techniques can dramatically impact sustainability initiatives:

-

Precision Farming: Devices such as drones assist check plant health and wellness efficiently.

-

Hydroponics & & Aeroponics: These soil-less growing strategies use less area and water while maximizing yield.

By leveraging these technologies within mushroom farming arrangements focused on producing mushroom coffee blends, we can see much more considerable decreases in ecological influences associated with traditional agriculture.

Challenges Encountering Mushroom Farming

While there are countless benefits associated with mushroom farming for coffee production, several difficulties still exist:

1. Market Awareness

Despite expanding popularity amongst niche audiences seeking alternatives like mushroom coffee advantages, wider market awareness stays limited contrasted to standard options.

2. Supply Chain Complexity

Establishing a reliable supply chain for high-grade ingredients can be discouraging because of limited manufacturers concentrating on lasting methods integrated with rising and fall need patterns throughout seasons.

This intricacy can influence product accessibility– making it vital for brand names focusing on these offerings to communicate successfully with consumers about sourcing requirements transparently.

The Future Expectation: Is Mushroom Coffee Below To Stay?

With boosting customer need for sustainable items combined with continuous interest in wellness fads– the future looks brilliant for both mushrooms themselves along with blends containing them!

As awareness grows concerning The gbmushroom Environmental Impact of Mushroom Farming for Coffee Manufacturing in addition to potential health benefits associated– expect proceeded technology within this field moving forward!

FAQs Regarding Mushroom Coffee

1. What is mushroom coffee made from?

Mushroom coffee generally contains ground medicinal mushrooms blended with normal or decaffeinated coffee beans– or often replaces them entirely!

2. Exist any type of adverse effects connected to taking in mushroom coffee?

While normally safe when consumed reasonably; people need to seek advice from healthcare providers if they have allergies or particular medical problems prior to introducing brand-new dietary modifications involving mushrooms!

3. Where can I find mushroom coffees?

You can acquire numerous brands on-line by means of ecommerce systems or examine regional food store focusing on natural foods!

4. How does one prepare mushroom-coffee drinks?

Preparation differs based upon brand guidelines however primarily includes brewing like regular immediate coffees liquified into hot water/milk mixtures!

5. Can anybody beverage mushroom-infused beverages?

Most individuals appreciate it securely but individuals pregnant/nursing/medicated should seek advice from physicians first due feasible interactions relying on kind chosen!

6. What makes it various from regular coffees? It normally contains lower high levels of caffeine degrees paired along with useful residential or commercial properties associated especially in the direction of certain types offered especially useful though preference might differ slightly too!

Conclusion

The expedition into The Ecological Influence of Mushroom Farming for Coffee Production discloses a promising opportunity toward sustainability within our food systems while at the same time profiting personal health! With its myriad advantages– from lowered land usage & & improved soil health– to improved cognitive feature & & immune support– it’s clear why many people are jumping onto this pattern!

As we proceed welcoming environmentally friendly solutions combined alongside delicious tastes– mushroom coffees show up positioned not simply as short lived fads but instead indispensable elements forming much healthier lifestyles moving forward! So go ahead– get on your own some delightful mixture tomorrow morning (or tonight), understanding you’re contributing positively in the direction of our world’s future one sip at a time!

Harnessing Modern Technology: The Rise of Asking Veterinarians Free Online for Family Pet Care

Introduction

In the electronic age, modern technology has actually penetrated practically every aspect of our lives, including how we take care of our cherished animals. Gone are the days when pet owners had to drive long distances or await hours in congested waiting areas to seek veterinary advice. With simply a couple of clicks, any person can now ask a vet free online and get expert recommendations right from the convenience of their homes. This improvement in family pet care is greater than just a fad; it indicates a radical change in how we come close to animal healthcare.

As we dive deeper into this emerging landscape, we’ll check out the different facets of on the internet vet consultations, the benefits they supply, and just how they’re altering the means we engage with our family pets’ health.

Harnessing Technology: The Surge of Asking Vets Free Online for Pet Dog Care

The increase of telemedicine generally has actually generated numerous benefits that have actually positively impacted both human and animal medical care. By utilizing innovation effectively, pet dog owners can now access a wealth of details and expert help without ever having to leave home.

1. The Development of Vet Care

Veterinary care has actually undertaken significant adjustments over the last few years. Beforehand, pet owners depended heavily on regional vets for all their needs. As technology advanced, so did the techniques readily available for pet care.

1.1 Historical Perspectives on Veterinary Services

Historically, vet services were limited by geography and access to details. The majority of pet proprietors consulted with their regional vets who supplied tailored however sometimes limited support based entirely on experience and available resources.

1.2 The Duty of Innovation in Modern Vet Practices

With developments in innovation– consisting of telecommunication devices and databases– vet techniques Expert pet medical insights have advanced considerably. Now, veterinarians can share understanding throughout borders and offer real-time assistance to pet dog owners anywhere in the world.

2. Why Ask a Veterinarian Free Online?

The choice to ask a veterinarian complimentary online comes from different elements that make this option interesting many pet owners.

2.1 Comfort at Your Fingertips

One of one of the most substantial benefits is comfort. Pet proprietors can get instant solutions without setting up an appointment or traveling.

- No traveling time

- Flexible timing

- Quick responses

2.2 Cost-Effectiveness

Accessing veterinary advice online can often be extra affordable than traditional consultations.

- Many systems supply cost-free options

- Reduced demand for emergency situation visits

- Access to several viewpoints without added costs

3. The Mechanics Behind Online Veterinarian Consultations

Understanding how these solutions feature is important for efficient use.

3.1 Platforms and Mobile Apps Available

There are numerous platforms where one can ask a veterinarian complimentary online:

|Platform Name|Features|Cost|| ———————-|———————————————–|———–|| Vetster|Video calls, conversation assistance|Varied|| Chewy’s Connect|24/7 assistance through chat|Subscription-based|| JustAnswer|Specialist Q&A solution|Pay-per-question|

3.2 How to Prepare for an Online Consultation

Preparation boosts the performance of your appointment:

- Gather clinical history

- Have inquiries ready

- Ensure good web connectivity

4. Kinds of Concerns You Can Ask an Online Vet

You could question what sort of queries are suitable when you choose to ask a veterinarian complimentary online.

4.1 Common Health and wellness Concerns

Pet owners frequently ask about:

- Symptoms (e.g., sleepiness)

- Dietary recommendations

- Vaccination schedules

5. Addressing Typical Misconceptions Concerning Online Vet Advice

Despite its climbing popularity, a number of misconceptions surround online veterinary consultations.

5.1 Quality vs In-Person Visits

Many believe that digital assessments do not have high quality contrasted to in-person gos to; nevertheless, qualified professionals can assess conditions with video consultations extremely well under certain circumstances.

5.2 Emergency situation Circumstances: When Need To You Go With In-Person Care?

While asking a veterinarian totally free online is very useful for several circumstances, emergencies must always require immediate activity– whether it’s going directly to an emergency situation clinic or contacting your key veterinarian immediately.

6. Structure Depend On with Online Veterinarians

Trust plays a crucial function when seeking advice concerning your fuzzy buddies’ health.

6.1 Qualifications Matter!

Always make sure that you’re speaking with certified veterinarians that have actually validated qualifications– this builds self-confidence in their expertise.

7. Situation Researches: Success Stories from Online Vet Consultations

Real-life instances display exactly how online assessments have positively affected pet care outcomes.

7.1 Improved Health Outcomes With Timely Advice

From identifying allergic reactions at an early stage to handling persistent diseases successfully through routine check-ins, these anecdotes highlight the efficiency of asking veterinarians free online versus traditional techniques alone.

8. The Future of Vet Medicine and Innovation Integration

As modern technology continues advancing, so also does its assimilation into vet practices worldwide.

8.1 Trends Forming Tomorrow’s Vet Clinics

Anticipated fads include boosted AI diagnostics capacities and a lot more easy to use platforms that allow smooth communication between veterinarians and pet moms and dads alike.

Frequently Asked Inquiries (FAQs)

Q1: Can I truly depend on online vets?

Absolutely! Numerous licensed vets supply on-line solutions through credible platforms where they verify credentials carefully prior to talking to clients.

Q2: Suppose my pet has severe symptoms?

In such situations, it’s best to visit an emergency situation facility rather than depend only on digital appointments; nonetheless, you may get in touch with an on the internet vet before heading out for immediate advice!

Q3: Are there charges associated with asking a vet cost-free online?

While some platforms supply entirely complimentary solutions, others could bill per question or membership fees depending upon extra features provided.

Q4: Can I obtain prescriptions via on-line consultations?

Yes! Accredited vets can suggest medicines after analyzing your pet’s condition throughout an on the internet assessment if necessary!

Q5: What types of animals can I consult about?

Most systems provide not only dogs and pet cats yet also various other tiny animals like bunnies or test subject– make sure you confirm with individual solution providers!

Q6: Just how do I recognize which platform is best for me?

Research various systems based on functions offered– ease-of-use aspects like mobile compatibility– and read evaluations from other users before making any decisions!

Conclusion

Harnessing technology has actually undeniably changed exactly how we come close to pet care today; asking veterinarians free online uses unrivaled ease while preserving access to quality details tailored specifically to our fuzzy companions’ requirements! Accepting this advancement ensures much better health and wellness results while fostering stronger partnerships between pet dogs and their caregivers throughout generations– really changing the area of vet medication as we know it!

In closing, think about integrating this contemporary method into your routine; nevertheless– it’s never been much easier– or even more fulfilling– to guarantee our beloved pets receive prompt specialist care!

Browsing Pet Dog Treatment: Just How to Ask a Vet Free Online for Expert Guidance

Introduction

In today’s fast-paced world, pet owners usually deal with challenges in providing the best care for their hairy pals. With advances in modern technology and the web, it has actually become much easier than ever before to seek skilled recommendations online. However just how can you effectively navigate the myriad of alternatives offered? This extensive overview will stroll you via everything you require to find out about navigating pet dog care and how to ask a vet totally free online for professional suggestions. From recognizing your pet’s demands to discovering credible on-line resources, we’ll cover all bases to guarantee your pet dog obtains the most effective treatment possible.

Understanding Your Pet’s Wellness Needs

What Are the Common Health Issues Pets Face?

Pets, just like human beings, are susceptible to a range of health problems. Understanding these conditions can be vital in giving efficient care.

Why Comprehending These Concerns Matters

Recognizing signs and symptoms early can make all the difference in therapy effectiveness and healing time. Being notified enables you to ask a veterinarian cost-free online specific concerns related to your pet’s condition.

The Relevance of Routine Veterinary Check-ups

How Frequently Ought to You Take Your Pet to The Vet?

Regular examinations are important for keeping your pet dog’s wellness.

- Dogs: At least yearly; bi-annual brows through for seniors.

- Cats: Annual examinations are vital; more frequent brows through for older cats.

What Occurs Throughout a Vet Visit?

During veterinary check outs, pet dogs undertake several exams:

By attending these consultations, you’ll collect useful insights that will aid when you later decide to ask a vet cost-free online about particular concerns.

How Online Vet Consultations Work

What Are Online Veterinarian Consultations?

Online veterinarian consultations allow pet owners to get in touch with certified vets by means of video clip calls or chat platforms.

Benefits of Online Consultations

- Convenience of consulting from home

- Access to experts not available locally

- Cost-effective contrasted to typical visits

How Do You Prepare for an Online Consultation?

Preparation is crucial for obtaining the most out of your assessment:

Being prepared enables you to properly ask a veterinarian free online, making the most of the visit’s value.

Finding Reputable Online Vet Resources

Where Can You Discover Trusted Veterinary Advice?

Identifying trusted sources is essential when looking for online veterinary advice.

Evaluating Trustworthiness of an Online Source

Before trusting an online resource, consider:

- Credentials of the veterinarian

- User evaluations and ratings

- Transparency relating to solutions offered

This will help in making certain that when you determine to ask a veterinarian totally free online, you’re doing so via trustworthy channels.

Navigating Animal Treatment: Just How to Ask a Vet Free Online for Expert Advice

When it comes time that you require specialist insight into your family pet’s health and wellness concerns, recognizing exactly how and what to ask makes all the distinction in obtaining high quality guidance.

Crafting Your Concerns Effectively

To get exact responses from an online veterinarian:

A well-crafted concern leads straight right into skilled recommendations customized specifically for your circumstance– remember this while considering how best to approach when you want to ask a veterinarian cost-free online!

Common Inquiries Pet Owners Have When Consulting Vets Online

What Are Common Signs That Require Vet Attention?

Understanding typical signs can direct when it’s required to connect:

- Persistent vomiting

- Unusual sleepiness

- Changes in appetite

- Behavioral changes

If you notice any of these indicators, it’s a good idea not just speak with yet additionally think about asking question on platforms where you can conveniently ask a veterinarian totally free online.

FAQs About Asking Veterinarians Online

1. Can I trust suggestions given by vets online?

Absolutely! As long as they’re qualified professionals and credible sources give them, their suggestions is reliable.

2. Exists a price related to asking veterinarians online?

While some systems bill fees for assessments, others supply free access or trial durations– always study beforehand!

3. Can I ask follow-up questions after my initial consultation?

Most systems permit follow-up queries; simply guarantee you’re clear on their policies beforehand!

4. What if my animal requires instant assistance?

For emergency situations, it’s constantly best first call your regional vet quickly instead of depending solely on on-line resources.

5. Exist restricts on what I can ask an online vet?

Generally no! However, intricate diagnoses might need an in-person browse through based on preliminary evaluations carried out remotely.

6. Can I make use of images or videos throughout my consultation?

Many holistapet systems urge sharing photos or video clips because aesthetic aids help vets provide even more accurate advice!

Conclusion

Navigating the complexities of animal care does not need to be discouraging any longer! With gain access to now at our fingertips using innovation improvements enabling us chances like asking a vet complimentary online questions customized specifically towards our cherished hairy buddies’ demands– there’s no factor not take advantage!

Remember constantly do extensive research prior to selecting whom/what system supplies such services guaranteeing reputation initially; then as soon as geared up with knowledge crafted questions leading straight towards specialist support– you’ll locate yourself rather relieved understanding specifically how best support each action along trip along with cherished pet dogs ahead!

Transforming Your IRA to Gold: A Step-by-Step Method to Rare-earth Element Investments

Introduction

In recent years, the allure of rare-earth elements, especially gold, has expanded considerably among financiers. As individuals seek security and safety for their retired life cost savings, many are asking themselves: How to convert IRA to gold? This comprehensive overview aims to demystify the procedure and provide you with an in-depth roadmap for transforming your conventional individual retirement account into a gold-backed IRA.

As we explore the subtleties of this financial investment strategy, you’ll learn about the advantages, obstacles, and required steps associated with converting your individual retirement account to gold By the end of this article, you’ll have a clear understanding of https://benkou.substack.com/p/how-to-convert-your-ira-into-a-gold just how to navigate this complicated landscape and make educated choices about your financial future.

Understanding the Essentials of IRAs

What is an IRA?

A Person Retired life Account (IRA) is a popular investment automobile developed to help people save for retired life while enjoying tax obligation advantages. There are several kinds of Individual retirement accounts– Standard IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs– all catering to various monetary situations and goals.

Why Take into consideration Gold as an Investment?

Gold has stood the test of time as a safe-haven possession. Throughout financial declines or periods of inflation, gold often retains its value much better than paper assets like stocks or bonds. Investors usually see gold as an effective hedge against market volatility.

Converting Your IRA to Gold: A Detailed Approach

Step 1: Assess Your Existing IRA

Before making any kind of approach transforming your IRA to gold, it’s crucial to examine your present retirement account. Are you currently holding a Standard individual retirement account or a Roth individual retirement account? Recognizing your present investment framework will certainly aid educate your next steps.

Sub-step: Review Financial investment Performance

Take supply of exactly how well your existing investments are doing. If you’re seeing torpidity or decreases in value due to market problems, it might be time to explore alternative possessions such as gold.

Step 2: Recognizing IRS Laws on Valuable Metals

The Internal Revenue Service (IRS) has certain policies regarding what kinds of steels can be kept in an individual retirement account. Generally:

- Eligible Steels: Only certain sorts of bullion coins and bars that meet minimum pureness criteria can be included.

- Storage Requirements: The IRS mandates that physical precious metals must be stored in an authorized depository instead of at home.

Step 3: Investigating Gold Financial Investment Options

When taking into consideration converting your individual retirement account to gold, you have several choices:

Each choice features pros and cons that merit cautious consideration.

The Process of Transforming Your IRA

Step 4: Choose a Dependable Custodian

Once you have actually chosen investing in gold through an individual retirement account, picking a custodian experienced in managing rare-earth element Individual retirement accounts is necessary. A custodian acts as the intermediary in between you and the IRS while managing your account.

Factors to Consider When Choosing a Custodian:

- Experience: Seek custodians with recognized track records.

- Fees: Recognize all connected charges– arrangement charges, storage space charges, purchase charges– to evaluate general costs.

- Security Actions: Investigate just how they protect client assets.

Step 5: Open up a Self-Directed IRA

To invest in gold straight using your retirement financial savings, opening a self-directed individual retirement account is vital. Unlike traditional IRAs managed by banks or banks with minimal investment choices, self-directed Individual retirement accounts allow even more versatility concerning different possessions like precious metals.

Pros and Disadvantages of Self-Directed IRAs

|Pros|Disadvantages|| ——|——|| Greater investment adaptability|Calls for more duty|| Possibility for diversity|Can entail higher charges|| Direct control over financial investments|May require additional study|

Step 6: Fund Your New Gold IRA

Once you’ve established your self-directed account with a custodian focusing on precious metals:

Step 7: Acquisition Gold

After funding your brand-new account:

Make sure all acquisitions comply with IRS rules pertaining to pureness levels and authorized products.

Step 8: Secure Storage Space Solutions

Once you have actually bought gold via your brand-new self-directed individual retirement account:

- Ensure that it’s saved at an accepted depository.

- Regularly look at storage space setups and make sure insurance policy protection is adequate.

Why Is Secure Storage space Important?

Storing physical assets like gold safely protects versus burglary or loss while adhering to internal revenue service laws– an essential aspect when transforming your IRA into precious metals.

Step 9: Display Your Investments Regularly

Investing in gold isn’t a “set it and forget it” strategy; maintaining tabs on market patterns is essential:

Benefits of Converting Your Individual Retirement Account to Gold

Diversification

Diversifying into precious metals helps spread out threat throughout numerous asset classes rather than relying solely on equities or bonds during unclear times.

Hedge Against Inflation

Historically, gold has kept its buying power over time contrasted to fiat currencies subject to inflationary pressures– making it an attractive choice for long-lasting security.

Challenges Associated with Precious Metal Investments

While there are lots of advantages connected with purchasing gold via an IRA:

- Market Volatility: Costs may change based on geopolitical events or financial data releases.

- Liquidity Concerns: Selling physical assets can take longer than selling off stocks or bonds conveniently traded on exchanges.

Frequently Asked Questions (Frequently asked questions)

FAQ 1: Just how do I begin transforming my traditional individual retirement account right into one backed by physical gold?

You’ll desire very first to review IRS rules relevant specifically towards rare-earth elements prior to selecting both an appropriate custodian specializing in such accounts while ensuring conformity throughout each step brought this journey towards protecting riches via concrete possessions like these!

FAQ 2: Are there any type of fines when transforming my retirement account into one made up generally out-of-gold?

Generally speaking– it depends! If performed through straight rollover no tax obligations ought to sustain given appropriate treatments are adhered to during deal handling stages including transfers made between accounts– the crucial lies within conformity described by controling bodies overseeing these matters!

FAQ 3: Can I save my physical bullion in the house as soon as converted?

Unfortunately not! The internal revenue service calls for that all holdings remain saved securely within approved depositories which have high safety and security criteria guaranteeing defense against theft/loss whilst continuing to be certified under government guidelines set forth governing such accounts– hence guarding both investors’ passions & & tax ramifications alike!

FAQ 4: Just how much can I add yearly in the direction of my freshly established self-directed gold ira?

For tax year2023 limitations stand at $6k/year if under age fifty ($7k if older)– these numbers may fluctuate yearly relying on regulatory modifications so always double-check present info offered online prior to proceeding further!

FAQ 5: What takes place if I desire access funds from my gold ira prior to retirement age?

Accessing those funds prematurely can result charges ranging normally around 10 percent unless qualifying scenarios apply such as disability/first-time home acquisition etc., yet remember maintain whatever recorded correctly just-in-case disagreements develop later down-the-line regarding eligibility requirements set forth via IRS standards controling these matters!

FAQ 6: Is investing entirely focused upon bullion coins better than supplies linked straight onto mining operations instead?

Ultimately depends upon individual threat resistance degrees; investing directly right into mining procedures brings fundamental risks linked carefully together with operational success while buying actual bullion offers innate worth no matter exterior aspects influencing efficiency therefore diversifying profiles may make sense too!

Conclusion

Converting Your individual retirement account to Gold: A Step-by-Step Method to Precious Metal Investments does not have to be frightening when come close to carefully and thoroughly complying with each described action provided below today! By establishing clearer paths ahead towards attaining financial growth in the middle of uncertainty bordering economic climates throughout our lifetimes– we acquire better control over our futures knowing valuable resources exist ready-to-protect us along this journey ahead! Whether seeking diversity alternatives shielding wealth against inflationary forces impending in advance– spending intelligently now ensures brighter tomorrows await us just past perspective line sparkling vibrantly beckoning forth possibility awaiting discovery!

Usual Errors in 401k to Gold Individual Retirement Account Rollovers and How to Prevent Them

Introduction

In precious metals ira reviews the ever-evolving landscape of retired life planning, lots of capitalists are exploring choices like gold Individual retirement accounts as a bush against market volatility and inflation. A 401 k to Gold IRA rollover uses a distinct chance to expand your retired life portfolio while securing your hard-earned cost savings. However, browsing this process can be stuffed with pitfalls. In this detailed guide, we’ll delve into the typical blunders that people make throughout 401k to Gold individual retirement account rollovers and give professional insights on just how to stay clear of them.

Understanding 401k to Gold IRA Rollover

What is a 401k?

A 401k plan is an employer-sponsored retirement savings plan that allows staff members to conserve for retirement on a tax-deferred basis. Payments are subtracted from workers’ paychecks before taxes are used, decreasing their taxable income. The funds expand tax-free up until withdrawal during retirement, whereupon withdrawals are exhausted as ordinary income.

What is a Gold IRA?

A Gold IRA (Individual Retirement Account) is a type of self-directed IRA that permits investors to hold physical gold and other rare-earth elements as part of their retired life portfolio. Unlike standard Individual retirement accounts that commonly hold paper possessions like supplies and bonds, a Gold individual retirement account offers diversity through substantial assets.

Why Consider a Rollover?

Rolling over your 401k into a Gold IRA can provide numerous advantages:

- Protection Against Inflation: Rare-earth elements often preserve their worth throughout economic downturns.

- Diversification: Including gold in your profile aids alleviate threats connected with stock exchange fluctuations.

- Tax Benefits: An appropriately performed rollover preserves the tax-deferred status of your investments.

Common Blunders in 401k to Gold Individual Retirement Account Rollovers and How to Stay clear of Them

Not Investigating Your Options

One of the very first mistakes people make is stopping working to thoroughly research their options before starting a rollover.

Ignoring Fees and Expenses

Many capitalists ignore the fees connected with establishing and keeping a Gold IRA.

Not Understanding IRS Regulations

The Internal Revenue Service (INTERNAL REVENUE SERVICE) has rigid policies concerning what can be included in a Gold IRA.

Failing to Do Due Diligence on Custodians

Choosing the best custodian for your Gold IRA is important yet frequently neglected.

Underestimating Storage space Requirements

Investors regularly underestimate the relevance of secure storage space for their priceless metals.

Not Thinking about Tax obligation Implications

While rollovers typically enable you to avoid prompt tax, there are still subtleties included that might affect you later on.

Steps for a Successful 401k to Gold Individual Retirement Account Rollover

Evaluate Your Present Financial Situation

Before making any moves toward rolling over your 401k right into a Gold individual retirement account, it’s necessary first to analyze your monetary health and wellness:

- Are you nearing retired life age?

- Do you have various other investments?

- What are your lasting financial goals?

Having clarity on these inquiries ensures that you’re making notified decisions concerning where you want your cash invested.

Selecting the Right Custodian

As previously pointed out, choosing an appropriate custodian is important:

- Look for client service ratings

- Compare costs

- Read independent reviews

- Verify regulatory compliance

Your custodian will certainly play an essential function throughout this procedure; do not rush this decision!

Initiating the Rollover Process

Once you have actually selected your custodian:

FAQs Regarding 401k to Gold IRA Rollovers

FAQ 1: Can I surrender my entire 401k right into a Gold IRA?

Yes, you can roll over all or component of your existing 401k balance into a Gold IRA relying on details problems set forth by both accounts’ providers.

FAQ 2: Are there any penalties for surrendering my 401k into a Gold IRA?

Generally, if done properly using direct transfer or trustee-to-trustee transfer, there should not be any charges sustained throughout the rollover procedure; nonetheless inappropriate implementation could lead you subjecting yourself extra taxes/penalties!

FAQ 3: What types of gold can I include in my Goldco account?

Qualifying types consist of specific bullion coins (e.g., American Eagles), bars meeting minimal purity criteria established by internal revenue service laws– check specifics before proceeding!

FAQ 4: Is it possible for me conduct this rollover myself without professional assistance?

Technically yes, but it’s highly advised that you seek advice from specialists aware of these processes! There’s much space for mistake when handling such significant sums– it’s ideal left up those experienced in this area!